2024 20% Business Deduction On Schedule C

If you are searching about Can I Take the Standard Deduction and Deduct Business Expenses? you’ve came to the right web. We have 15 Pics about Can I Take the Standard Deduction and Deduct Business Expenses? like Can I Take the Standard Deduction and Deduct Business Expenses?, Form Ar3 – Itemized Deduction Schedule – 2016 printable pdf download and also Change ITR-4 schema version for AY 2020-21. Here it is:

Can I Take The Standard Deduction And Deduct Business Expenses?

Photo Credit by: www.keepertax.com

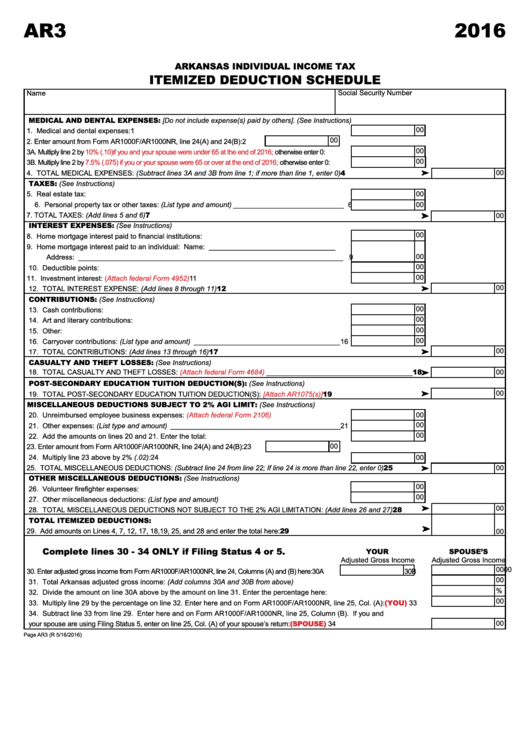

Form Ar3 – Itemized Deduction Schedule – 2016 Printable Pdf Download

Photo Credit by: www.formsbank.com pdf deduction ar3 itemized schedule form

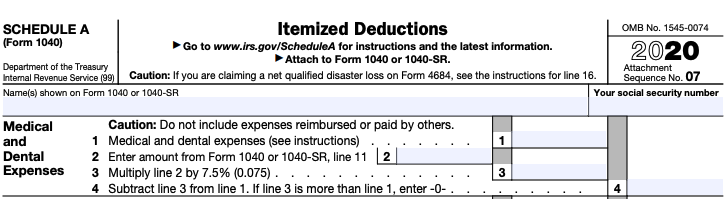

Itemized Deduction Schedule A Overview 547 Income Tax 2020 – YouTube

Photo Credit by: www.youtube.com

New 20% Deduction For Schedule C Filers – YouTube

Photo Credit by: www.youtube.com

Blogger Taxes: Reporting Income & Business Deductions For This Year

Photo Credit by: www.ecommerceceo.com

What Qualifies As A Business Deduction? | Jones CPA Group, P.C.

Photo Credit by: www.jonescpagroup.com deduction qualifies business

Change ITR-4 Schema Version For AY 2020-21

Photo Credit by: www.hostbooks.com

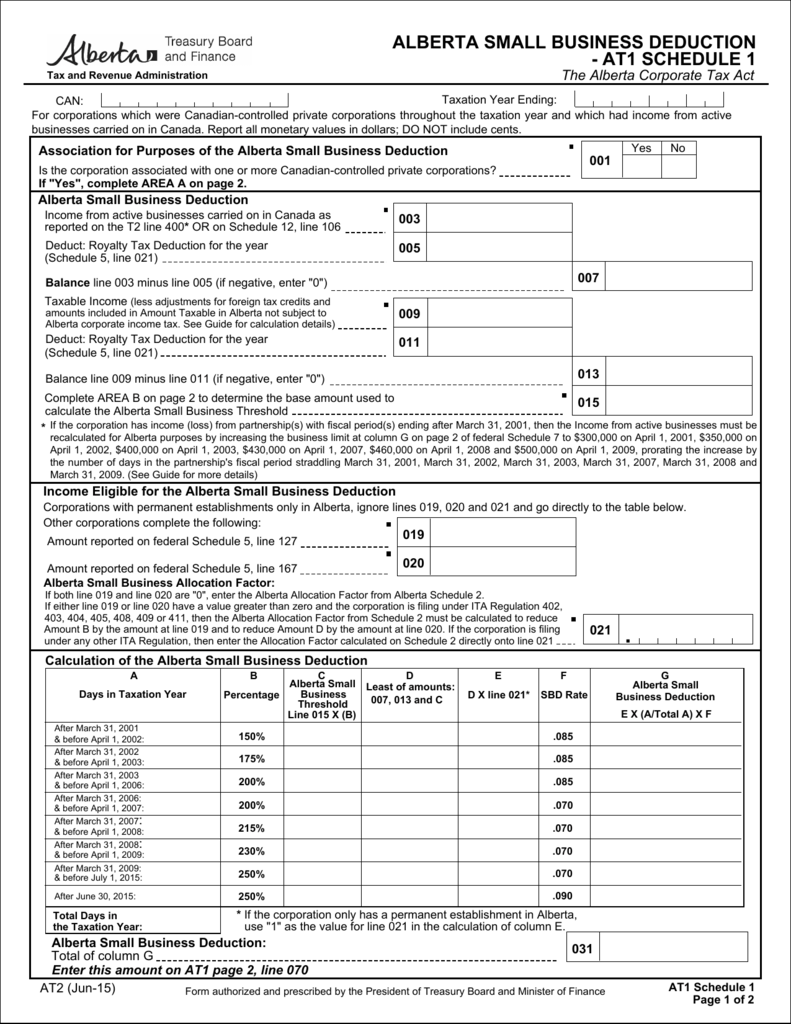

Alberta Small Business Deduction – At1 Schedule 1

Photo Credit by: studylib.net deduction business alberta at1 schedule

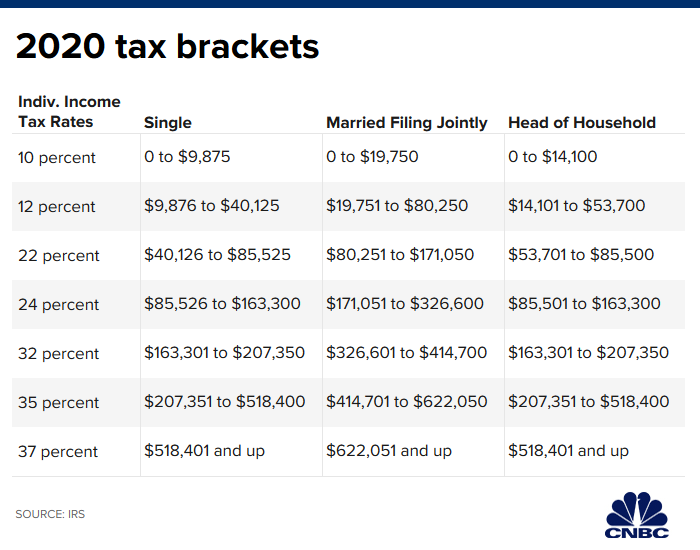

Standard Business Deduction 2022 – Home Business 2022

Photo Credit by: homesbusinesss.blogspot.com brackets deduction irs taxes rates federal withholding everything filing gains capital jointly cnbc avoiding advisory changements pourraient venir filers

Freelance Writer Tax Deductions – ArcticLlama

Photo Credit by: www.arcticllama.com schedule deductions tax business form freelance writer taxes writing hobby vs businesses

Schedule 1 ("Above The Line") Deductions

Photo Credit by: help.holistiplan.com

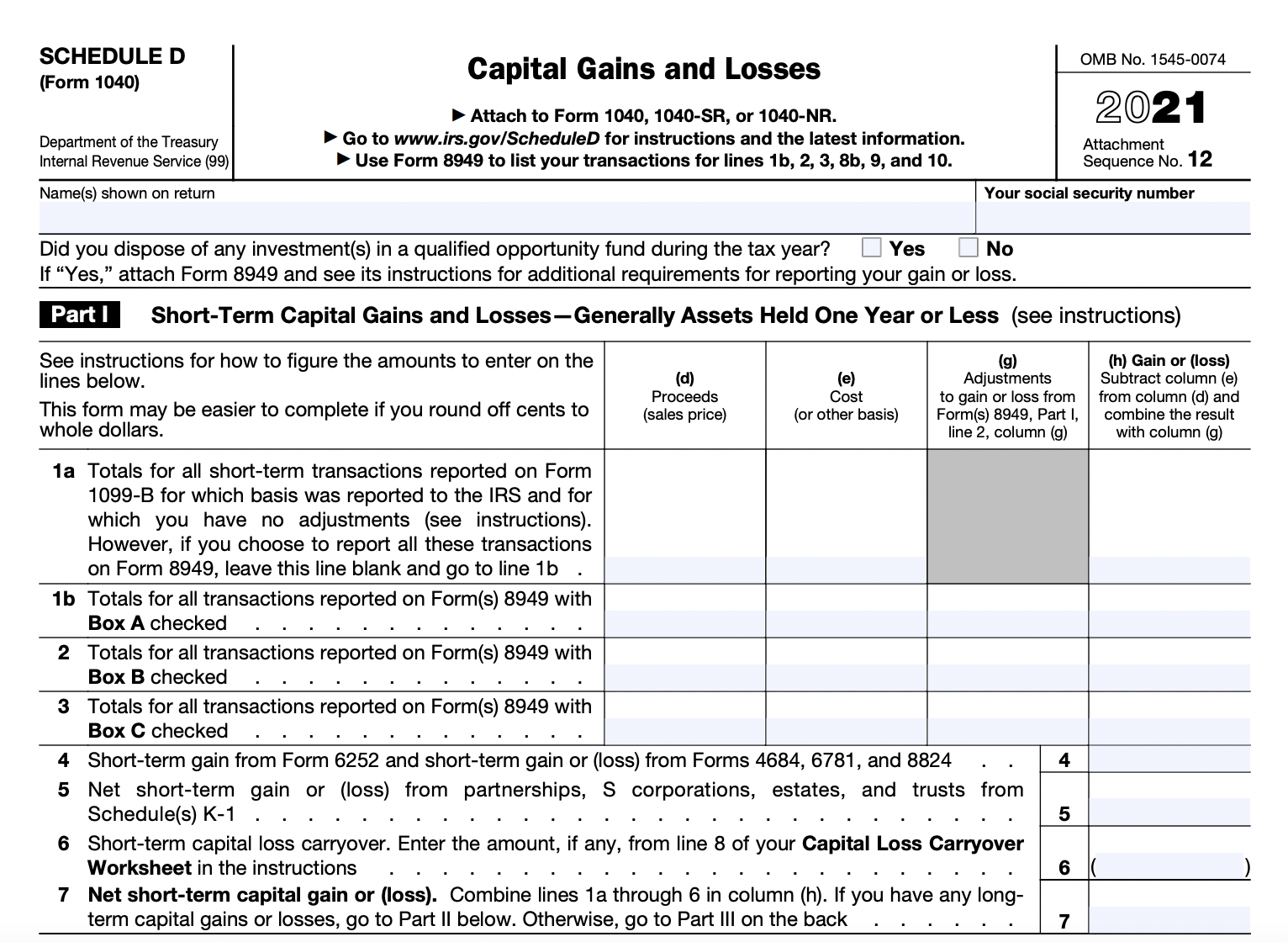

How To Report Crypto On Your Taxes: 5-Step Guide – TokenTax

Photo Credit by: tokentax.co

Capital Loss Tax Deduction – FinanceGourmet.com

Photo Credit by: financegourmet.com capital loss deduction tax offset losses gains

Itemized Deduction Schedule A Overview 502 Income Tax 2020 – YouTube

Photo Credit by: www.youtube.com

What Your Itemized Deductions On Schedule A Will Look Like After Tax

Photo Credit by: www.pinterest.com deductions schedule itemized tax look business after worksheet deduction reform forbes taxes diem pay companies lost per need irs read

2024 20% Business Deduction On Schedule C: Alberta small business deduction. Itemized deduction schedule a overview 502 income tax 2020. New 20% deduction for schedule c filers. Schedule 1 ("above the line") deductions. Blogger taxes: reporting income & business deductions for this year. Deduction business alberta at1 schedule